The Development Status and Trends of LED Lighting Industry

1、 Introduction

LED, short for Light Emitting Diode, is a solid-state semiconductor device that can convert electrical energy into visible light. After 2010, benefiting from policy support and technological progress, the overall LED industry chain has developed rapidly, and the LED application industry has also shown a high-speed growth trend. Currently, the proportion of output value in the LED industry chain has exceeded 80%.

As one of the most important application areas of LED, the service life and related performance of products have been continuously improving in recent years, while the overall unit price of products has also steadily decreased, driving the continuous increase in the penetration rate of LED products.

2、 Industrial chain

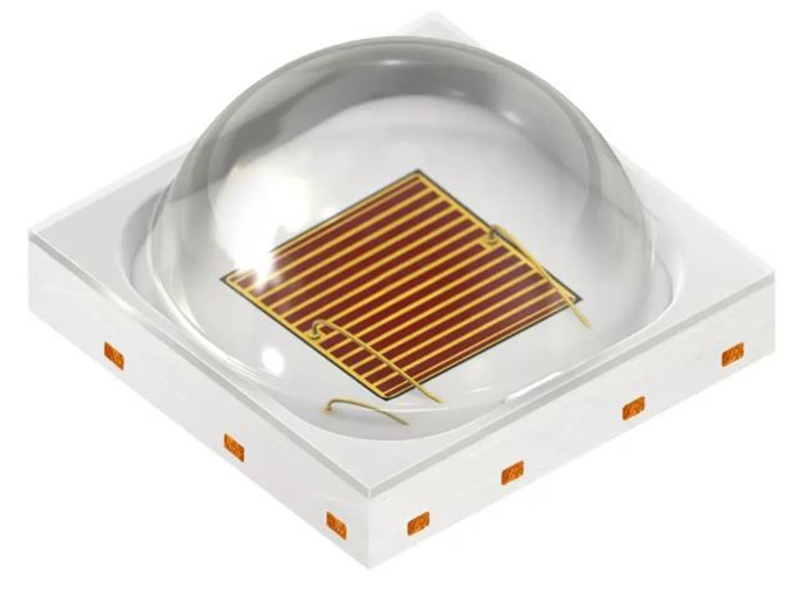

Upstream: Various raw materials, mainly including LED beads, electronic components, structural components, and packaging materials. Among them, the main electronic components, structural components, packaging materials, etc. belong to mature industries, which have relatively full industry competition, stable production technology, and sufficient supply. Therefore, the demand for raw material procurement in this industry can be fully guaranteed; LED beads are the core components of LED lighting products, and with the continuous improvement of technological level and production capacity, they contribute to the large-scale promotion and application of LED lighting products. Downstream: The application scenarios are relatively broad, covering home, commerce, industry, office, education, etc. Its end consumers are mainly enterprises, institutions, and individual consumers. The export of LED lighting products mainly adopts the ODM/OEM model, and downstream customers mainly include large home product retail stores, supermarkets and other channel customers, as well as brand customers in the lighting and home appliance fields, as well as engineering merchants. The main sales channels in China include shopping malls, supermarkets, distributors, hardware, e-commerce, etc.

3、 Industry Development Overview

LED lighting products can usually be divided into LED lamps and LED light sources. Due to the fact that LED lighting fixtures with integrated design are usually easier to integrate with the surrounding environment and have more aesthetic effects, as the unit price of the product continues to decrease, the acceptance of LED lighting fixtures continues to increase, gradually becoming the main category in LED lighting products. Currently, they have occupied about 80% of the market size. The specific situation is as follows:

From a regional distribution perspective, Western Europe, North America, and the Asia Pacific region are the main markets for global LED lighting products. According to IHS data, the size of the LED lighting market in the aforementioned regions was approximately 47.532 billion US dollars in 2018, accounting for 89.57% of the global market as a whole.

At present, China is the world's largest LED lighting market (a single country), accounting for 26.48% of the global market size in 2018. Except for China, the Asia Pacific region, North America, and Western Europe respectively accounted for 28.03%, 19.08%, and 15.99% of the market size.

IHS predicts that by 2025, Western Europe, North America, and the Asia Pacific region will continue to be the main global markets for LED lighting, with China's market share further increasing to 36.21%.

4、 Industry business model

The main business processes of the LED lighting industry include research and development, production, sales, etc. Currently, the industry's business models mainly include OEM, ODM, OBM, etc.

1 OEM mode

OEM mode (Original Equipment Manufacturer mode) refers to LED lighting manufacturers producing products completely according to customer design and functional quality requirements, and customers using their own brand and sales channels for product sales.

2 ODM mode

ODM mode (Original Design Manufacturer mode) refers to the LED lighting manufacturer mainly completing product development and producing products according to customer orders, while customers use their own brand and sales channels for product sales.

In the ODM mode, some customers will provide specific product specifications and performance requirements to manufacturers, and LED lighting production enterprises will complete the specific product development and production process; Some LED lighting manufacturers also utilize their market research capabilities to closely follow market trends and propose innovative product designs, and form relatively complete product solutions to promote to customers.

This type of model requires LED lighting manufacturers to have strong market foresight and influence, and the implementers are generally led by LED lighting leading enterprises.

3 OBM mode

OBM mode (Original Brand Manufacturer mode) refers to LED lighting manufacturers independently designing and developing products, and selling them under their own brands. The OBM mode requires LED lighting manufacturers to have not only research and development design capabilities and manufacturing capabilities, but also strong brand appeal and channel network.

5、 Industry competition pattern

After years of development, the global LED lighting industry has a relatively complete industrial system, forming an industrial pattern centered on East Asia, North America, and Europe. Among them, LED lighting industry enterprises in developed countries such as North America and Europe focus on channel construction, brand operation, and some basic research, while retaining the production and manufacturing of some high-end or differentiated products. The traditional lighting brand leaders represented by Xinnuofei (formerly Philips Lighting), Osram, General Electric, etc. mainly come from European and American countries. These brands have been deeply involved in lighting for many years and still have certain design capabilities and brand effects in the LED lighting industry.

In recent years, against the backdrop of the rapid rise of China's lighting industry, the rapid development and application of LED lighting, and the increasingly fierce competition in the international lighting market, some European and American lighting giants have carried out a series of self lighting business integrations, adjusted and sought to occupy a certain market position in the new stage of lighting industry development. The business integration events of some European and American lighting giants

On the other hand, relying on a relatively complete industrial chain, East Asia, represented by China, has become a global manufacturing center for LED lighting industry, accounting for up to 70% of global output value. In China, LED lighting enterprises are mainly distributed in the southeastern coastal areas of Jiangsu, Zhejiang, Fujian, and Guangdong, forming three major industrial clusters in the Yangtze River Delta, Pearl River Delta, and Fujian Jiangxi region. Among them, representative enterprises in the Yangtze River Delta region include Sunshine Lighting, Debon Lighting, Opu Lighting, Kaiyao Lighting, etc. Representative enterprises in the Pearl River Delta region include Foshan Lighting, Sanxiong Aurora, etc. Representative enterprises in the Fujian Jiangxi region include Tongshida, etc.

According to Csil data, the export scale of lighting products in China was 39.021 billion US dollars in 2018, with North America, Europe, and the Asia Pacific region being the main export regions of lighting products in China. The export scale to these regions was 32.620 billion US dollars, accounting for 83.60% of the overall export scale, with the United States, Germany, the United Kingdom, the Netherlands, Japan, and other major export destinations for lighting products in China.

At present, the main competitors in the LED lighting industry include the following types:

One is internationally renowned lighting brands represented by Xinnuofei, Osram, etc. These companies rely on their technological and brand marketing advantages, and through global layout, mainly use ODM/OEM models to purchase from Chinese manufacturing enterprises, ultimately achieving global sales; The second is domestic lighting enterprises represented by OPP Lighting, Mulin Forest, etc. These enterprises have established or acquired a certain systematic brand and channel capabilities through self construction or acquisition, and achieve sales through independent brands or acquired brands; The third is represented by domestic lighting enterprises such as Sunshine Lighting, which have gained high recognition from major global lighting industry brands and channel providers due to their strong technological research and development capabilities, strict production quality management level, and cost control advantages. Currently, they mainly provide ODM services and are actively exploring the layout of brand and channel fields. In addition, some lighting companies with lower technological levels or smaller scales in China mainly provide manufacturing services to domestic and foreign customers through OEM models, with customers mainly concentrated in developing countries such as Africa, South America, and the Middle East. 6、 Industry development trends

On the one hand, compared to traditional lighting products, LED lighting products have higher electro-optic conversion efficiency and a significantly longer service life than traditional lighting products such as incandescent lamps and energy-saving lamps, making them more energy-efficient and environmentally friendly; On the other hand, LED lighting products have a wide range of application scenarios, among which integrated design LED lamps are usually easier to integrate with the surrounding environment, more in line with the increasingly diverse, fashionable, and personalized needs of consumers. These factors together drive the rapid growth of the LED lighting industry.

In the future, with the continuous development of the social economy, LED lighting will still dominate the new global lighting market and continue to replace traditional lighting in the existing market. In the future, the LED lighting industry will further develop around the core concepts of convenience, health, and circulation, continuously evolving towards three major development directions: intelligent lighting (lighting control and connection), human factor lighting, and circular economy:

Intelligent lighting will become an important development direction for future lighting

In recent years, IoT related technologies such as big data, cloud computing, and artificial intelligence have flourished. Based on the semiconductor properties of LED lighting, it can become a carrier and interface in the process of data connection, providing more possibilities for product intelligence. By combining with intelligent control, the characteristics and advantages of LED lighting can be highlighted to the maximum extent, meeting the lighting needs of users for dimming, color adjustment, remote control, interaction, scalability, and other aspects. The integration of lighting technology with advanced technologies such as the Internet of Things, cloud computing, and artificial intelligence has become an important component of smart homes and smart buildings. IHS predicts that the global market size of intelligent lighting systems will increase from $12.692 billion in 2016 to $32.72 billion in 2021, and intelligent lighting will become an important development direction for future lighting.

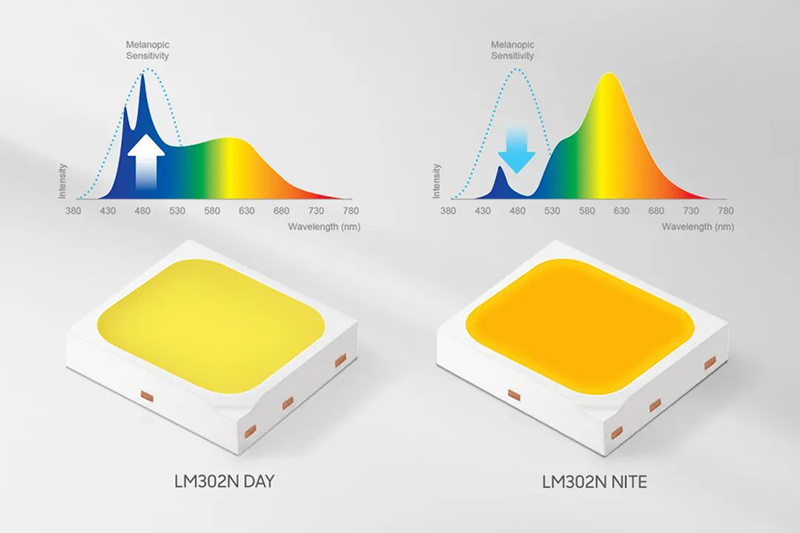

The concept of "human factor lighting" will promote the continuous upgrading of the lighting industry

Human induced lighting refers to the need to focus on the visual, physiological, and emotional effects caused by lighting in a human centered manner when providing lighting, including immersive experiences, eye comfort, improving work atmosphere and efficiency, and stabilizing emotions. Taking office as an example, designing office areas and lighting based on specific work and activities significantly improves employee creativity and work efficiency. People are more likely to concentrate under good visual conditions and can improve their sense of happiness and motivation.

In recent years, people have put forward higher requirements for personalized and fashionable design of product additional functions and appearance. The lighting industry needs to conduct relevant design research, human-machine interface design, human factors engineering, and color and material science design based on user experience, in order to endow products with high added value and excellent product experience. With the increasing awareness of the important role of light in human physical and mental health, the lighting industry will pay more attention to the impact of lighting on human function, health, comfort, and happiness. The concept of "human factor lighting" will promote the continuous upgrading of the industry. This article is reprinted on Penglan Finance!

The 3 circular economy models will help promote the sustainable development of the LED lighting industry

Circular economy refers to an economy and industrial system with recoverable and renewable resources. Compared to the linear consumption model of the industrial era, circular economy and sustainable development complement each other, emphasizing the harmonious coexistence of social and economic systems and natural ecosystems. At present, circular economy has become a widely recognized resource utilization model worldwide, and the lighting industry will also be affected by this. In order to achieve efficient utilization and recycling of resources, the LED lighting industry will continue to improve in design, sustainability, product quality, product recycling, and other aspects. In addition, under the circular economy model, the lighting industry will also transition from traditional product sales to a business model that combines services and products. The 2025 Strategic Roadmap released by the European Lighting Association believes that with increasing emphasis on energy efficiency, improving lighting quality through LED products, intelligent lighting systems, and a human centered circular economy will become a new driving force for the growth of the lighting market. The circular economy model will help promote the sustainable development of the LED lighting industry.